Monthly Update: Houston Metro Employment

The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Reading Time: 1 minute

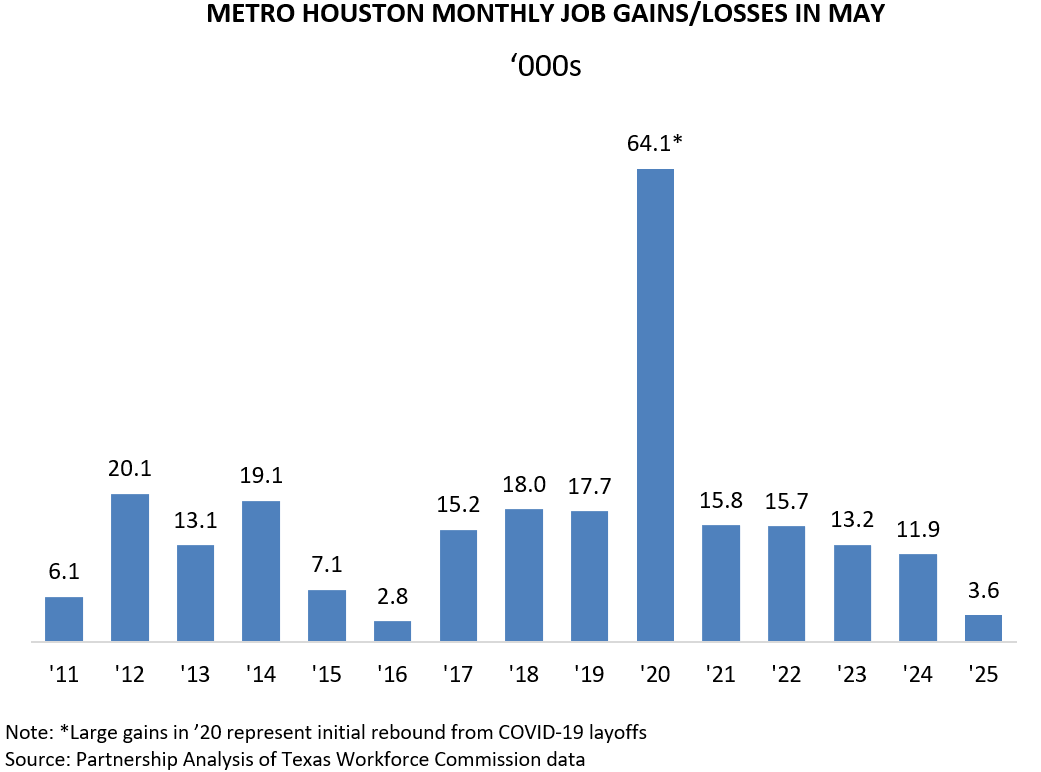

Metro Houston created 3,600 jobs in May, according to Current Employment Statistics data released today by the Texas Workforce Commission (TWC). That is relatively weak compared to historic trends, as businesses deal with higher uncertainty and delay in making long-term hiring decisions. Many sectors shed employees over the month, with strong hiring in restaurants and bars keeping the overall number above water.

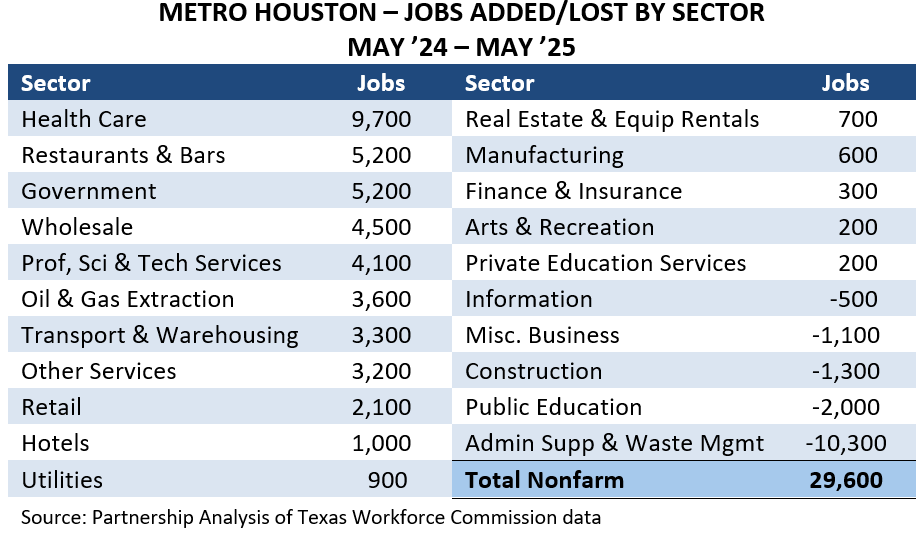

Over the past 12 months, Houston’s economy added 29,600 jobs - weaker than the 57,600 jobs it added on average for the same period in the 10 years preceding the COVID-19 pandemic.

Three sectors have led employment gains over the past 12 months. Health care added 9,700 jobs to treat the region’s fast-growing population. Restaurants added 5,200 new cooks, servers, bartenders, and back-of-house staff. Government (defined here to exclude public education) experienced strong growth earlier in the year, and has since leveled off. Sectors with more moderate growth of between 1,000 and 5,000 jobs include wholesale trade; professional, scientific, and technical services; oil and gas extraction; transportation and warehousing; retail trade; hotels; and other services.

Sectors losing employees include office and administrative support services, public education, construction, miscellaneous business, and information. Office and administrative support services shed a significant number of jobs in January but has slightly rebounded since then.

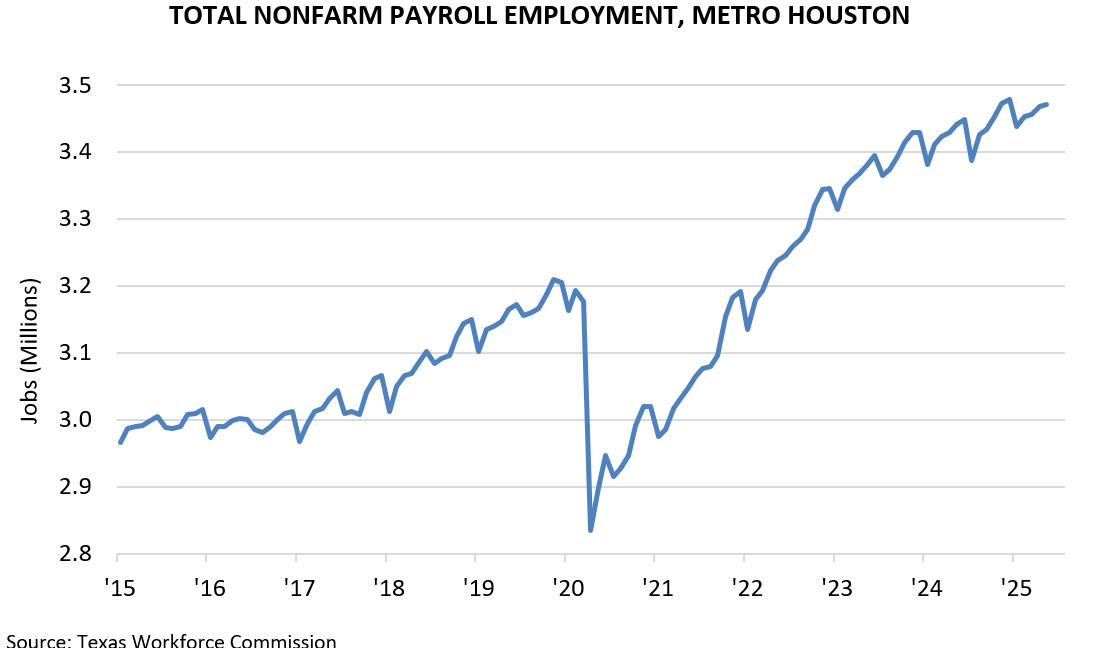

Total non-farm payroll employment for the region now stands at 3,471,300.

Prepared by Greater Houston Partnership Research

Colin Baker

Manager of Economic Research

Greater Houston Partnership

bakerc@houston.org

Clara Richardson

Analyst, Research

Greater Houston Partnership

crichardson@houston.org