Quarterly Update: Industrial Market

The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Reading Time: 2 minutes.

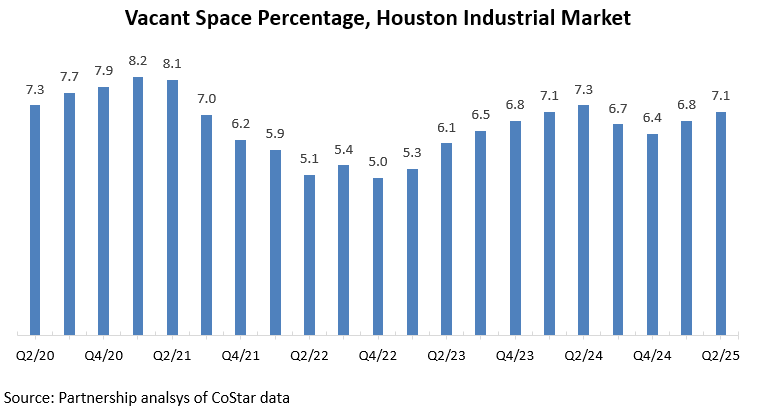

The demand for industrial and warehouse space in Houston has fluctuated over the past few years. The vacancy rate reached a five-year low of 5.0 percent in Q4/22, driven by strong absorption and record construction activity. Since then, vacancy has gradually increased, peaking at 7.3 percent in Q2/24 as new supply continued to outpace demand. As of Q2/25, the vacancy rate stands at 7.1 percent, still elevated compared to the ’22 low, but slightly below last year’s peak.

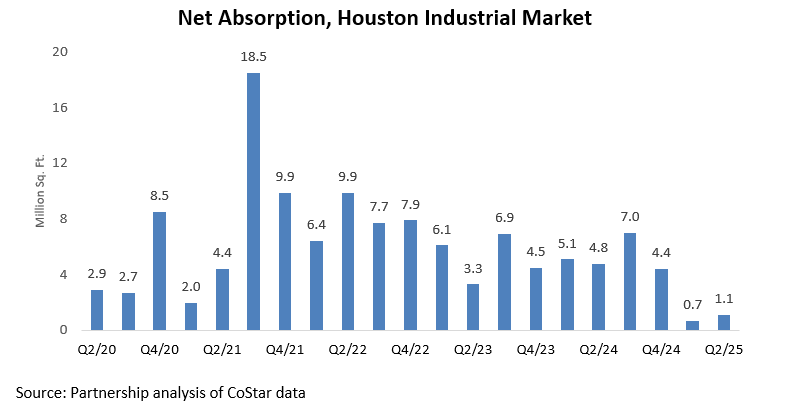

Net absorption in Houston’s industrial market has continued to soften compared to the stronger leasing activity seen in ’24. In Q2/25, net absorption totaled 1.1 million square feet, rising sharply from 679,865 square feet in Q1/25, but remaining well below the elevated levels recorded last year. The modest overall pace of absorption reflects a continued slowdown in tenant demand amid persistent new supply additions.

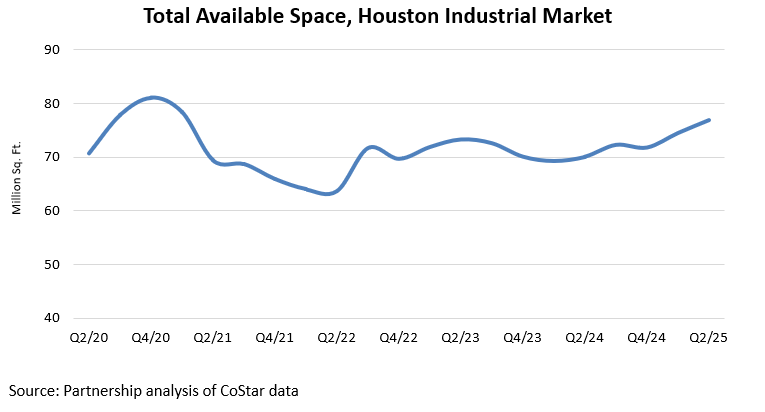

At the end of Q2/25, Houston had approximately 76.9 million square feet of industrial and warehouse space listed as available. This figure includes direct and sublet space that is vacant, occupied but on the market, available for sublease, or expected to become available in the near future.

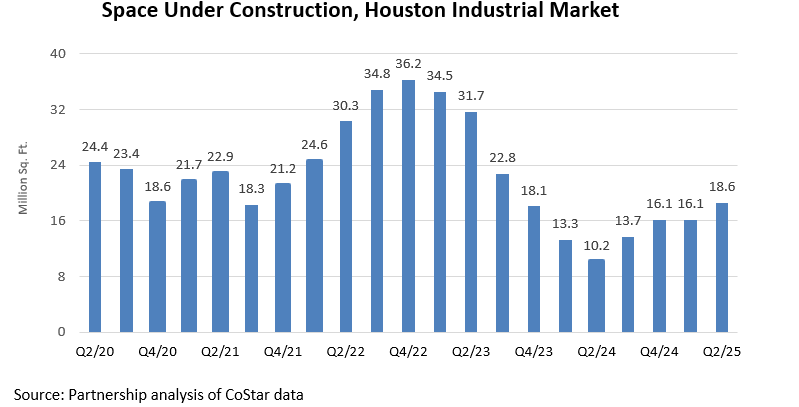

Higher interest rates, tighter lending standards, and softer absorption have slowed building activity in Houston’s industrial market. As of Q2/25, 18.6 million square feet were under construction, still about half the market’s recent peak of 36.2 million square feet in Q4/22.

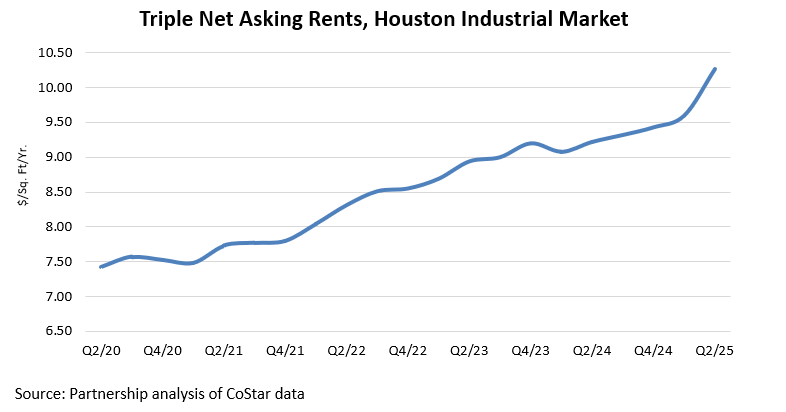

Despite weaker absorption, industrial rents in Houston continue to rise. The average triple net (NNN) rent reached $10.27 per square foot per year in Q2/25, up from $9.22 in Q2/24 and $8.94 in Q2/23. Under NNN lease terms, tenants are responsible for expenses such as property taxes, maintenance, utilities, and security. Over the past five years, rents have climbed 38 percent, reflecting continued demand for quality space, even amid a more cautious leasing environment.

Prepared by Greater Houston Partnership Research

Leta Wauson

Research Director

lwauson@houston.org