Quarterly Update: Retail Market

The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Houston’s retail market remains a steady performer among the city’s commercial real estate sectors, supported by ongoing population and job growth. The vacancy rate inched up to 5.5 percent in Q2/25, slightly above both the prior quarter and the same period last year. While retailers continue to show interest in space, leasing momentum has slowed, with net absorption turning negative at -93,516 square feet—down from 227,597 square feet in Q1/25. Rents averaged $20.32 per square foot, down slightly from the previous quarter. Construction activity also declined, with 3.9 million square feet underway, reflecting a more cautious development environment.

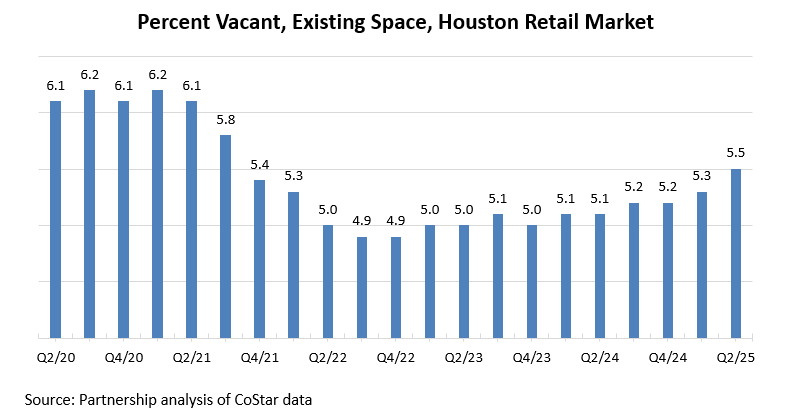

Vacancy rates rose early in the pandemic but began trending down in ’21 as the economy recovered. After peaking at 6.2 percent in Q3/20, rates declined steadily through most of ’23 before inching up again in ’24. The rate rose from 5.1 percent in Q2/24 to 5.5 percent in Q2/25, reflecting a modest increase in vacancy. Robust population growth and a sustained return to in-person shopping continue to support demand for retail space despite shifting consumer behavior.

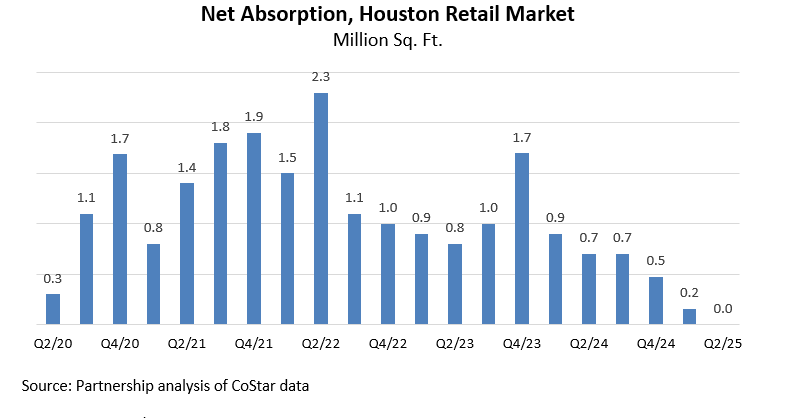

The market recorded negative net absorption of 93,516 square feet in Q2/25, the first quarter of contraction in over five years and a sharp reversal from the 816,000 square feet absorbed in Q2/24. This continues the downward trend that began in mid-’23 and suggests more cautious expansion strategies by retailers, even as vacancy remains low and leasing activity persists. Taken together with a slight drop in rents, the data may indicate the beginning of a subtle shift in market conditions.

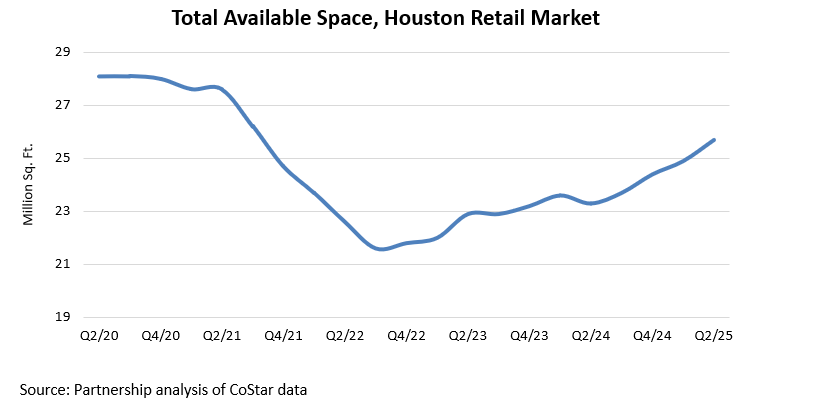

At the end of Q2/25, the total space being marketed, including vacant, occupied yet available, available for sublease, or expected to become available amounted to approximately 25.7 million square feet. This represents an increase from 23.3 million square feet in Q2/24.

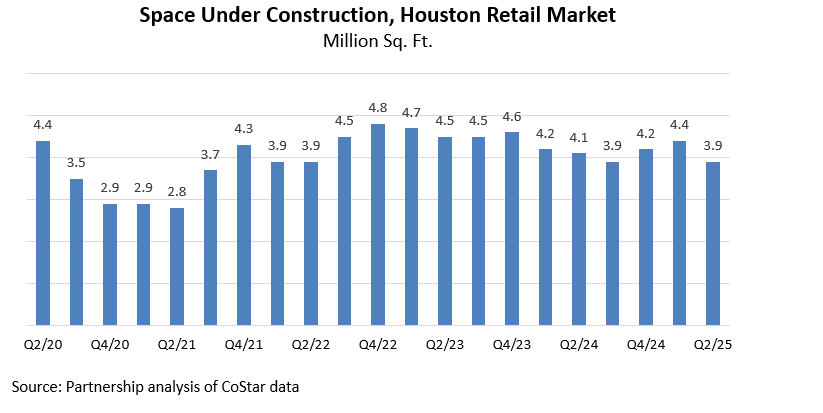

Retail construction has slowed due to higher interest rates and tighter lending standards. As of Q2/25, Houston had approximately 3.9 million square feet of retail space underway, down from 4.1 million square feet in Q2/24 and 4.2 million in Q4/24.

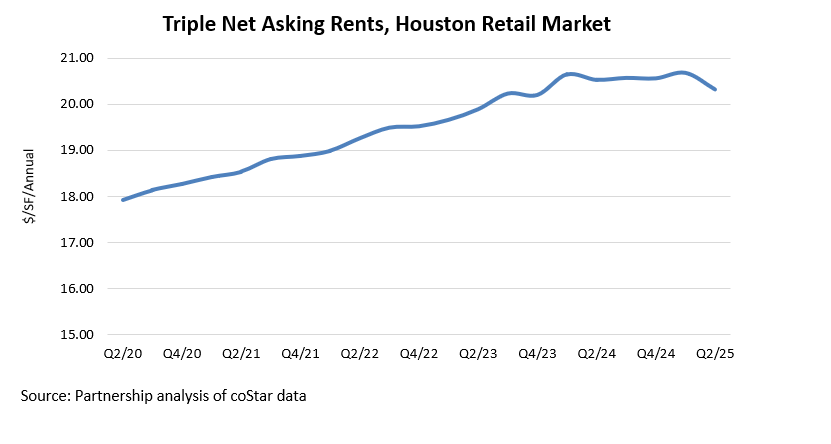

After years of consistent growth, retail rents in Houston dipped slightly in Q2/25. The average triple net (NNN) rent fell to $20.32 per square foot per year, down from $20.53 in Q2/24 but still above $19.89 in Q2/23. These rates are quoted as NNN, meaning tenants are responsible for covering all expenses associated with their share of building occupancy, including taxes, maintenance, utilities, and security. The modest decline may reflect early signs of adjustment in the broader retail leasing landscape.

Prepared by Greater Houston Partnership Research

Leta Wauson

Research Director

lwauson@houston.org